Now You Really Need to Know About S-Corp Tax Savings

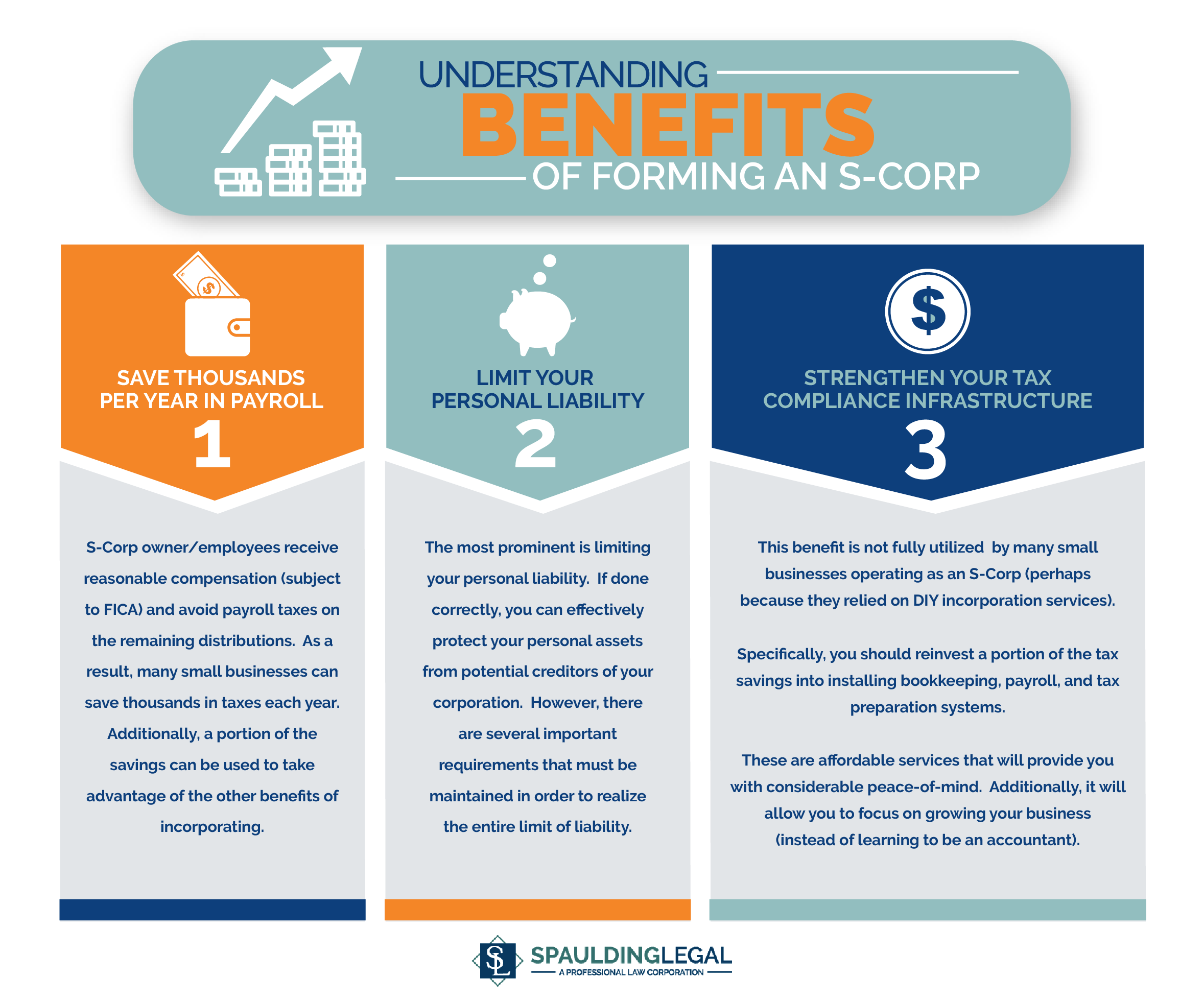

If you are self-employed, an independent contractor, or operating a sole proprietorship you may be interested in learning more about a well-known tax saving strategy—forming a corporation or LLC and electing to be taxed under Subchapter S of the Internal Revenue Code (“IRC”). This is commonly referred to as forming an S-Corp. Although the tax savings of operating an S-Corp are very real (under the right circumstances), it does come with additional compliance costs (filing fees, other taxes, returns, etc.). As a tax attorney that has represented several hundred individuals and small businesses, I felt it would be helpful to provide an honest and detailed breakdown of the requirements and identify some of the common mistakes people make.

Disclaimer: This article was drafted for informational purposes only. It is not a substitute for legal representation. The concepts and laws discussed in this article are generalizations and may not apply the same way for each factual scenario. Therefore, when assessing whether forming an S-Corp is the best option for you, it is important to seek legal advice outside of this article.