If you are self-employed, an independent contractor, or operating a sole proprietorship you need to learn more about a well-known tax saving strategy—forming a corporation or LLC and making an election under Subchapter S of the Internal Revenue Code (“IRC”). This is commonly referred to as forming an S-Corp. Although the tax savings of operating an S-Corp are very real (under the right circumstances), it does come with additional compliance costs (filing fees, other taxes, returns, etc.). As a tax attorney that has represented several hundred individuals and small businesses, I want to provide an honest and detailed breakdown of the requirements and identify some of the common mistakes people make.

Disclaimer: This article was drafted for informational purposes only. It is not a substitute for legal representation. The concepts and laws discussed in this article are generalizations and may not apply the same way for each factual scenario. Therefore, when assessing whether forming an S-Corp is the best option for you, it is important to seek legal advice outside of this article.

For ease of review, here are the areas I expand upon below:

FICA vs. SECA

Here we will look at the difference between FICA and SECA, which will help you better understand the mechanics of switching to an S-Corp

Reasonable Compensation—GET THIS RIGHT!

When switching to an S-Corp you need to make sure the S-Corp is paying “reasonable compensation” to any employee/owner. If you fail to pay reasonable compensation, the IRS will happily step in and assist, which will result in significant penalties and interest.

Additional Taxes and Fees to Consider

Because DIY incorporation services want to make a sale, they only give you the benefits of forming an S-Corp. The fact is, there are several additional fees, taxes, and costs to consider when calculating the net savings. Again, many people benefit from S-Corp tax savings, but there is a right way and wrong way to go about it.

Overall Benefits (tax and non-tax)

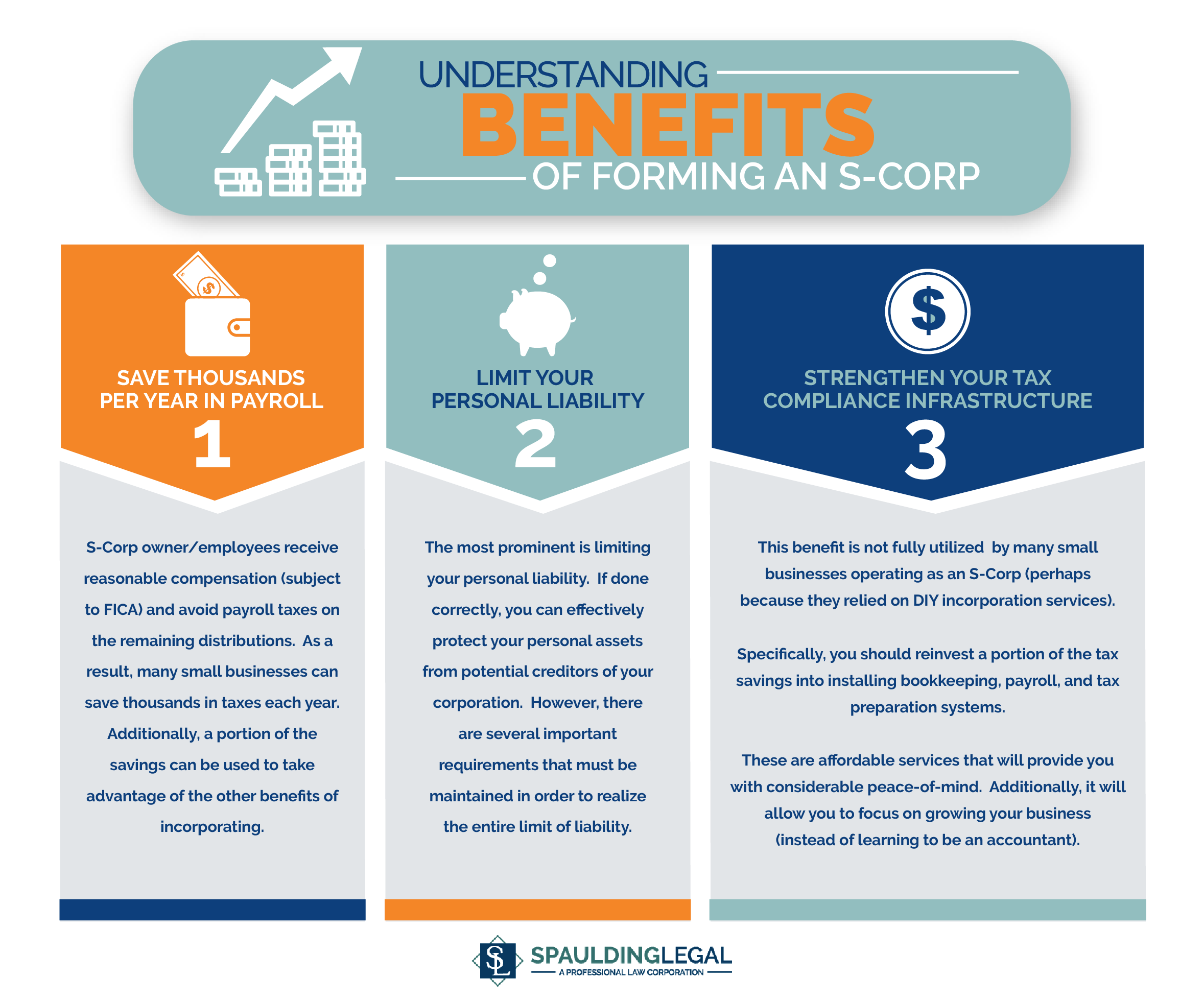

1. You can save thousands in payroll taxes.

2. You have the ability to re-invest a portion of the savings into streamlining compliance (bookkeeping, tax preparation, etc.). This will provide significant savings long-term because it will reduce the risk of tax audits, costly representation fees, and associated penalties.

3. Limited liability protection for the owners. In other words, if everything is setup correctly and maintained you can protect your personal assets (home, bank accounts, etc.).

FICA v. SECA

A. Components of the Current Payroll Tax System

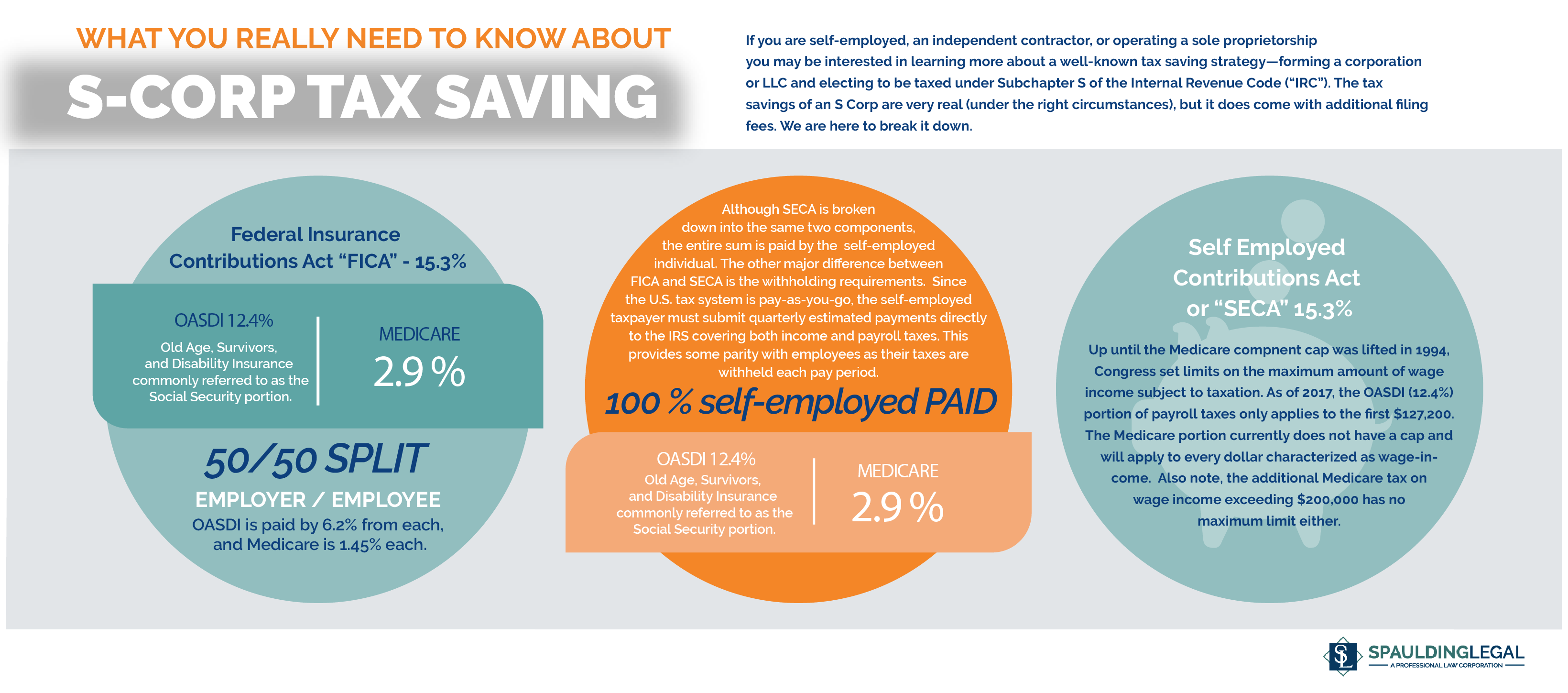

The current payroll tax system funds several government programs including unemployment insurance, Medicare, and social security retirement to name a few. Tax revenues are collected through the Federal Insurance Contributions Act (“FICA”) and the Self Employed Contributions Act (“SECA”). Whenever you see FICA, you should know that we are talking about employers and employees. Conversely, SECA applies to self-employed, independent contractors, and sole proprietors. Despite both acts assessing a 15.3% total payroll tax, each act does so in a different way.

1. Breaking Down FICA

Again, the total tax liability is 15.3% and is broken down into two components:

-

The Old Age, Survivors, and Disability Insurance (“OASDI”) commonly referred to as the Social Security portion, which amounts to a total of 12.4%; and

-

Medicare, which amounts to 2.9%.

These components are then shared equally between the employer and employee. Therefore, for OASDI the employer pays 6.2% and the employee pays 6.2%. For Medicare, the employer pays 1.45% and the employee pays 1.45%. For an illustration see graphic 2 above.

NOTE: As of 2013, there is an additional .9% Medicare tax generally applied to taxpayer wages exceeding $200,000.

2. Breaking Down SECA

SECA breaks out into the same two components as FICA (OASDI and Medicare). However, the self-employed taxpayer is directly responsible for the entire 15.3% payroll tax liability (the .9% additional Medicare tax is also applicable). Therefore, the components are not broken down into an employee and employer share. The other major difference between FICA and SECA is the withholding requirements. Since the U.S. tax system is pay-as-you-go, the self-employed taxpayer must submit quarterly estimated tax payments directly to the IRS covering both income and payroll taxes. This provides some parity with employees as their taxes are withheld each pay period.

3. Amounts Subject to OASDI and Medicare Tax

Up until the Medicare component cap was lifted in 1994, Congress set limits on the maximum amount of wage income subject to taxation. As of 2017, the OASDI (12.4%) portion of payroll taxes only applies to the first $127,200. The Medicare portion currently does not have a cap and will apply to every dollar characterized as wage-income. Also note, the additional Medicare tax on wage income exceeding $200,000 mentioned above has no maximum limit either.

B. Brief History of The Payroll Tax System

The taxation of wages became a part of the U.S. tax system more than two decades after the 16th Amendment passed. Payroll taxes emerged from the enactment of the Social Security Act of 1935, which Congress legislated in response to the Great Depression. The tax rate initially started at two percent; the employee and employer were each responsible for half. The government used the tax revenue collected to provide unemployment compensation and public aid to other needy Americans. From 1937 to 1956 the payroll tax rate stayed relatively low (never exceeding 4%). However, after 1956 programs funded by the payroll tax evolved and expanded drastically.

By 1972, the Social Security system expanded to include disability insurance, payouts to widows(ers), dependents, and the Medicare program. In order to fund the expanding Social Security system payroll tax rates were steadily increased. By 1990, the payroll tax rate had increased 765% from its original two percent rate. Concurrently, payroll tax collections grew from under 10% of federal revenues in the 1940s to over 34% today.

Recent History

Since 1990, the payroll tax rate has mostly gone unchanged. However, the amount of wages subject to the full payroll tax noticeably increased from $51,300 in 1990 (indexed for inflation to $92,000) to $127,200 today. The increase in payroll tax liability from that period amounts to an addition $2,500 of payroll tax revenues per individual worker reaching the cap. Accordingly, despite having the same rate, the overall tax revenues collected have increased since 1990. The overall increase in payroll tax revenues created the current wage income disparity between small businesses entities by allowing only one entity the ability to receive a reasonable portion of investment income (not subject to payroll taxation).

Reasonable Compensation

Determining “reasonable compensation” is perhaps the most important and overlooked aspect of forming an S-Corp. Without it, there is no way to calculate the tax savings of making the conversion. And therefore, it is impossible to determine if it is worth doing in the first place. Luckily, the analysis is not terribly difficult or time consuming. Nevertheless, it does require an understanding of what factors are relevant and what is at stake.

Why is it important and what is at stake?

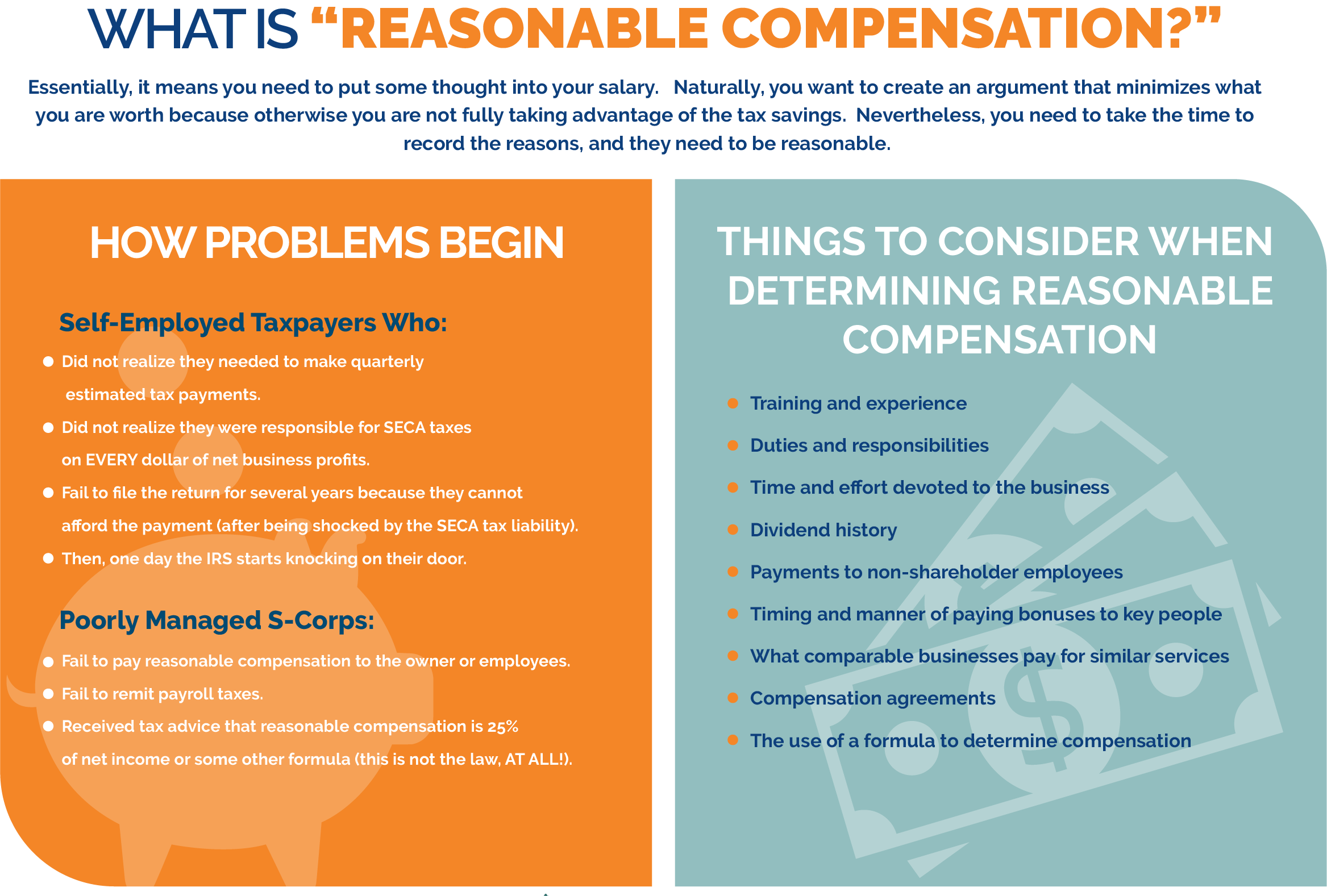

Over the years, the majority of my tax controversy cases have involved two types of taxpayers (see details below). Coincidentally, both groups share one thing in common—a general misunderstanding of employment taxes.

-

Self-Employed Taxpayers

- Did not realize they needed to make quarterly estimated tax payments.

- Did not realize they were responsible for SECA taxes on EVERY dollar of net business profits.

- Fail to file the return for several years because they cannot afford the payment (after being shocked by the SECA tax liability).

- Then, one day the IRS starts knocking on their door.

-

Taxpayer Mismanagement of an S-Corps

- Fail to pay reasonable compensation to the owner/employees.

- Fail to remit payroll taxes.

- Received tax advice that reasonable compensation is 25% of net income or some other formula (this is not the law, AT ALL!).

So what is reasonable compensation…?

Reasonable compensation has developed primarily from judge made law (common law). In other words, the law comes from cases litigated in the United States Tax Court (or other applicable federal courts). There has been a litany of cases dealing with reasonable compensation over the years. However, there are three important cases to know about (all decided after 2010):

-

David E. Watson, P.C, v. United States of America 2010

-

Sean McAlary Ltd, Inc. v. Commissioner of Internal Revenue 2013

-

Glass Blocks Unlimited v. Commissioner of Internal Revenue 2013

Watson Case

In the Watson case, a CPA (irony?) formed an S-Corp to limit payroll taxes. Mr. Watson had net income of over $200,000 and paid himself $24,000 in salary (passing the remaining profits through free of payroll taxes). However, the IRS took issue with this because the earnings received by the S-Corp were primarily (if not entirely) from the services performed by Mr. Watson. Accordingly, the IRS challenged the salary and won in Tax Court (and on appeal). As a result, the IRS was able to recharacterize a portion of his non-wage distributions as wages, which resulted in a hefty tax bill (plus penalties and interest).

Takeaway: The IRS has the authority to recharacterize S-Corp distributions if it can show the wages paid were not reasonable for the services provided.

McAlary Case

In McAlary, the Court gave us a few important takeaways. First, it defined what full-time year round employment meant (2,080 hours). Additionally, we see discussions of two important definitions of reasonable compensation (1) replacement cost; and (2) fair market value. These stand for the idea that an owner/employee pays a salary that they would expect to make on the open market (or what they would expect to pay someone to take their position in the S-Corp).

Glass Blocks Case

Glass Blocks shows us that your S-Corp can have a loss and still be required to pay you reasonable compensation. In this case, the S-Corp had a net profit of $877 for the year. Additionally, the S-Corp made distributions to the shareholder of approximately $30,000. However, the S-Corp did not pay any wages to the shareholder during the year. The IRS later recharacterized these distributions as wages subject to FICA. This seems unfair, right? After all, how can you be required to pay taxes on $30,000 of wages when you really didn’t make any money? Well, this could have been easily avoided if the distributions were treated properly (perhaps as shareholder loans, etc.).

What does all this mean?

Essentially, it means you need to put some thought into your salary. Naturally, you want to create an argument that minimizes what you are worth because otherwise you are not fully taking advantage of the tax savings. Nevertheless, you need to take the time to record the reasons, and make them reasonable. Here are a few things to look at:

-

- Training and experience

- Duties and responsibilities

- Time and effort devoted to the business

- Dividend history

- Payments to non-shareholder employees

- Timing and manner of paying bonuses to key people

- What comparable businesses pay for similar services

- Compensation agreements

- The use of a formula to determine compensation

Once you have analyzed the factors above and determined your reasonable compensation you can get an idea of the net tax savings.

What Tax Forms does an S-Corp Need? Are there Additional Fees?

This section will cover many of the other considerations left out of marketing materials for forming an S-Corp. In other words, it includes some of the additional taxes and costs that are netted against your tax savings. The goal is to give you a more accurate view of whether forming an S-Corp is right for your situation.

-

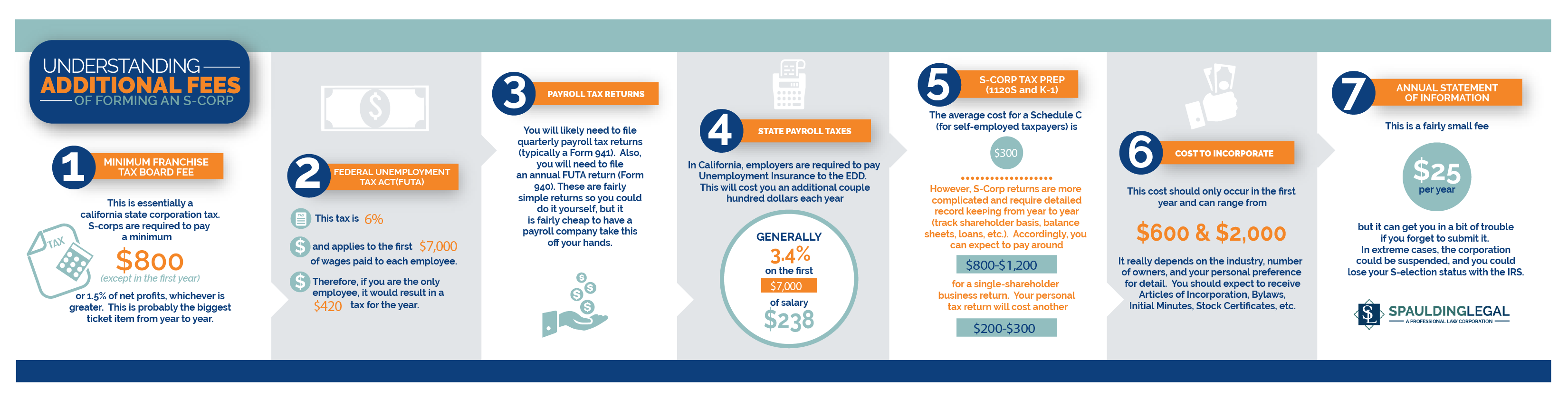

Federal Unemployment Tax Act (FUTA)

- This tax is 6% and applies to the first $7,000 of wages paid to each employee. Therefore, if you are the only employee, it would result in a $420 tax for the year.

-

Minimum Franchise Tax Board Fee

- This is essentially a California state corporation tax. S-Corps are required to pay a minimum of $800 (except in the first year) or 1.5% of net profits, whichever is greater. This is probably the biggest ticket item from year to year.

-

Payroll Tax Returns

- You will likely need to file quarterly payroll tax returns (typically a Form 941). Also, you will need to file an annual FUTA return (Form 940). These are fairly simple returns so you could do it yourself, but it is fairly cheap to have a payroll company take this off your hands.

-

State Payroll Taxes

- In California, employers are required to pay Unemployment Insurance to the EDD. This will cost you an additional couple hundred dollars each year (generally 3.4% on the first $7,000 of salary ($238)).

-

S-Corp Tax Preparation Fees (1120S and K-1)

- The average cost for a Schedule C (for self-employed taxpayers) is $300-$500. However, S-Corp returns are more complicated and require detailed record keeping from year to year (track shareholder basis, balance sheets, loans, etc.). Accordingly, you can expect to pay around $800-$1,200 for a single-shareholder business return. Your personal tax return will cost another $200-$300.

-

Cost to Incorporate

- This cost should only occur in the first year and can range from $600 and $3,000. It really depends on the industry, number of owners, and your personal preference for detail. You should expect to receive Articles of Incorporation, Bylaws, Initial Minutes, Stock Certificates, etc.

-

Annual Statement of Information (CA Secretary of State)

- This is a fairly small fee ($25 per year), but it can get you in a bit of trouble if you forget to submit it. In extreme cases, the corporation gets suspended, and you could lose your S-election status with the IRS.

Benefits of Forming an S-Corp

The tax benefits of forming an S-Corp are best illustrated by the info-graphic above. The main goal is to limit the amount of payroll taxes you owe each year. Self-employed taxpayers owe payroll taxes on every dollar of net profits. S-Corp owner/employees receive reasonable compensation (subject to FICA) and avoid payroll taxes on the remaining distributions. As a result, many small businesses can save thousands in taxes each year. Additionally, a portion of the savings can be used to take advantage of the other benefits of incorporating.

Example

Taxpayer X will save $10,000 in the first year by incorporating. X can use $2,500 of those savings to implement bookkeeping, payroll, and tax preparation services for the year. Accordingly, X has not only saved tax money, but they have reinvested a portion back into their business to limit personal liability, reduce the chance of an audit, improve infrastructure, and protect their business long-term.

As illustrated in the example, there are several other advantages to incorporating your business (even as an independent contractor). The most prominent is limiting your personal liability. If done correctly, you can effectively protect your personal assets from potential creditors of your corporation. However, there are several important requirements that must be maintained in order to realize the entire limit of liability.

Here is a list of some of the more important requirements:

-

Corporate Formalities: maintain your corporate books (meetings, minutes, etc.).

-

Avoid undercapitalization: maintain sufficient assets in the business and/or adequate insurance.

-

DO NOT COMMINGLE personal and business funds.

-

All in all, you need to treat the corporation as a corporation.

Tax Compliance Infrastructure

Another extremely important (and often overlooked) advantage of incorporating is the strengthening of your tax compliance infrastructure. This benefit is not fully utilized by many small businesses operating as an S-Corp (perhaps because they relied on DIY incorporation services). The concept is illustrated in the example above. Specifically, you should reinvest a portion of the tax savings into installing bookkeeping, payroll, and tax preparation systems. These are affordable services that will provide you with considerable peace-of-mind. Additionally, it will allow you to focus on growing your business (instead of learning to be an accountant).

Conclusion

I have helped many clients get out of difficult tax situations caused by failing to operate their S-Corp properly. The process is long, stressful, and significantly more costly than doing it right from the outset. Therefore, please take the time to understand the basic concepts above, conduct your own research, and seek legal counsel when applicable.

To learn more about how you can save taxes and strengthen your business, please call us at 760-932-0042 to schedule a free confidential consultation. You can also email us at [email protected].

Related Articles